Introduction

The service of automatic checking of the EU VAT numbers allows for completely maintenance-free monitoring of status of the entity in the VIES system.

All checking activities are performed by our systems, and the user, after each completion of the checking, can log in to his account and download a report containing the results of all performed checks. Defining checks is carried out with the use of a schedule, by means of which the user determines the frequency of checks performed.

The service is available in the Professional and Individual Plan and is dedicated in particular to companies that have to verify up to tens of thousands of contractors every month.

The maximum number of monitored EU VAT numbers in the Professional plan may not exceed 10,000. In the case of Individual plans, the limit may be higher and depends on the contracted number of inquiries. Each inquiry made as part of the EU VAT monitoring service is billed in the same way as inquiries carried out using the API interface.

Group creation and scheduling

To be able to perform EU VAT number checks, it is necessary to create a group. A group is a set of EU VAT numbers to which a specific check type and a specific check schedule are assigned.

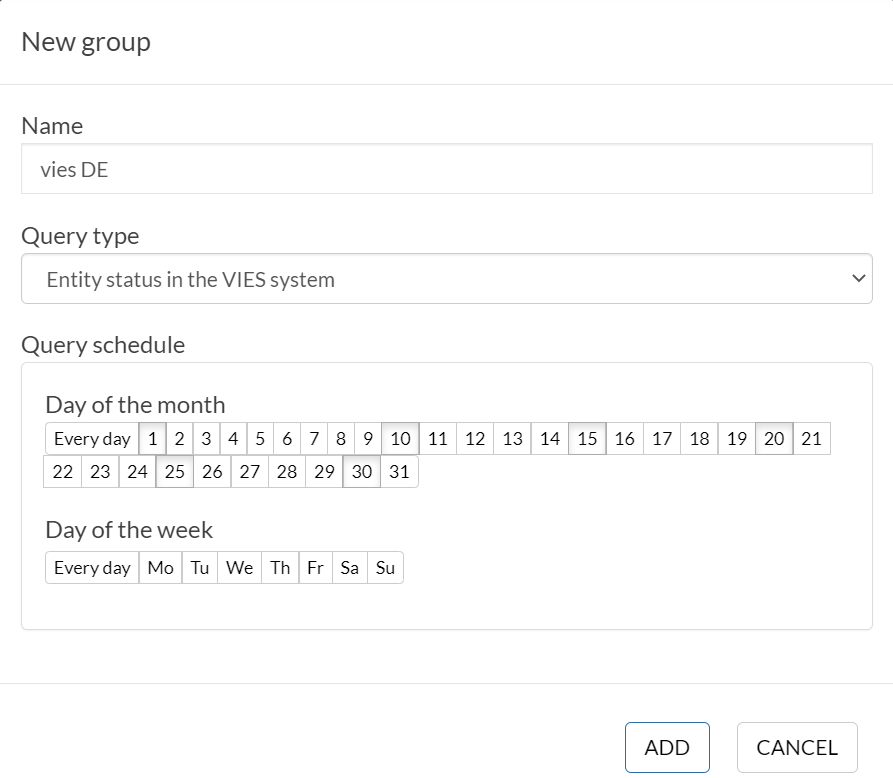

After logging in and moving to the “Monitor” tab, you should click the Add new group button. A window will appear in which you must enter the name of the group, define the type of verification and set a schedule that defines the days on which the EU VAT numbers belonging to this group are to be checked.

When specifying the schedule, please note that each check performed by the EU VAT Monitor (VIES) will be billed as a separate inquiry. This means that if the group will contain, for example, 1000 EU VAT numbers, and the schedule is set to check the group of 5 days a month, then 5000 inquiries in total will be counted in the month.

The figure below shows the creation of a new group for the daily checking of the taxpayer in the VAT register.

Only after creating a group, it is possible to define EU VAT numbers to be checked within a given group.

Managing monitored EU VAT numbers

Managing monitored EU VAT numbers is possible only after selecting a given group.

EU VAT numbers import

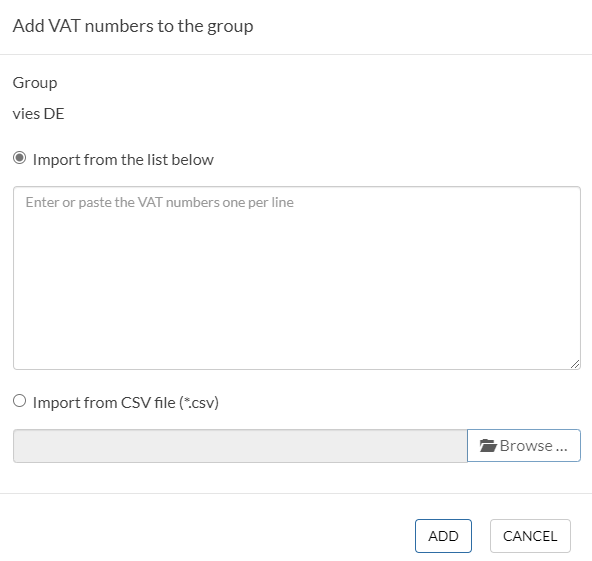

To add or import NIP numbers to a selected group from a CSV file, click the button with the + sign

A window will be displayed that allows you to add EU VAT numbers by entering them or pasting from the clipboard (Ctrl + v). It is also possible to indicate a CSV file (the file must have the * .csv extension) containing EU VAT numbers in one column. After entering EU VAT numbers, press the Add button to start the import process.

Finally, the system will display a summary of the import process, which will display the total number of successfully imported EU VAT numbers, for example:

Import completed successfully. Number of valid EU VAT numbers: 4.

After importing the numbers, the first and subsequent checks will be performed automatically according to the schedule set for a given group.

Search for EU VAT numbers

To search for a specific EU VAT number and display only the verification number for that number, click on the drop-down list with the inscription All numbers and select the EU VAT number from the list or enter its beginning in the text field.

Removal of EU VAT numbers

To remove a given EU VAT number from the selected group, click the button with the x sign

A window will be displayed informing that checks will no longer be performed for the removed EU VAT number.

Removal of the EU VAT number from the selected group should be confirmed by clicking the Delete button.

Attention! It should also be remembered that after removing the EU VAT number, it will not be possible to view the history of the checks performed.

Management of checks

Viewing checks

The list of checks performed for all EU VAT numbers is displayed automatically after entering the Monitor tab.

The list of checks performed in the current group contains the following columns:

Check date– date and time of the check with an accuracy of one second.EU VAT number– EU VAT number for which the check was performed.Status– descriptive status informing about the result of the check.Code– numeric status informing about the result of the check.Status change– the field can have 3 values:Lack of data– in case the check is performed for the first time.Yes– the value means that the status has changed since the last check.No– value means that the status has not changed since the last check.

Filtering checks

Filtering of displayed queries is possible for:

EU VAT numberCheck date

In order to limit the displayed checks to a given EU VAT number, click on the drop-down list with the inscription All numbers and select the EU VAT number from the list or enter its beginning in the text field. After confirming your selection, only checks performed for a given EU VAT number will be displayed.

In order to limit the displayed checks only to a given day, click on the drop-down list with the inscription All dates and select a specific check date from the list or enter its beginning in the text field. After confirming your selection, all EU VAT checks made on that day will be displayed.

Sorting the displayed checks

It is possible to sort the list of performed checks using each of the columns. To sort the checklist by the Code column, click the triangle to the right of the column name. An upward triangle signifies ascending sort, and a downward sort – descending sort.

Export of checks

It is possible to export the currently displayed list of checks at any time by clicking the Export button.

Then select the file format (CSV or TXT). After confirming the selection of the file format, the system will export the currently displayed data on the list and ask for the location where the downloaded file containing the exported data will be saved.