VIES – Verification and automation in cross-border e-commerce trade

The development of e-commerce opens new opportunities for small and medium-sized enterprises, particularly in the area of international (cross-border) sales. Thanks to the reach provided by the Internet, companies can easily reach customers in different countries, contributing to revenue growth and global expansion.

In light of the dynamic development of cross-border trade in Europe, where 70% of internet users already shop online [1], and one-third of them buy from other EU countries, the security and efficiency of international transactions become crucial. Particularly important is the proper verification of contractors in the VIES (VAT Information Exchange System).

However, entering foreign markets requires careful planning, including thorough verification of contractors to avoid financial and tax risks.

Verification of foreign contractors – why is it important?

Verification of contractors, especially regarding VAT, is crucial in international business. The European Union has introduced the VIES system, which allows checking whether a given business entity is registered as a VAT payer in another EU member state.

This enables entrepreneurs to:

- Ensure contractor credibility – lack of registration in the system may indicate that the company is not conducting legal business activities.

- Avoid errors in tax documentation – correct VAT identification is necessary for applying zero VAT rate in intra-Community transactions.

- Minimize the risk of tax fraud – VIES helps identify potential abuses, such as fictitious companies.

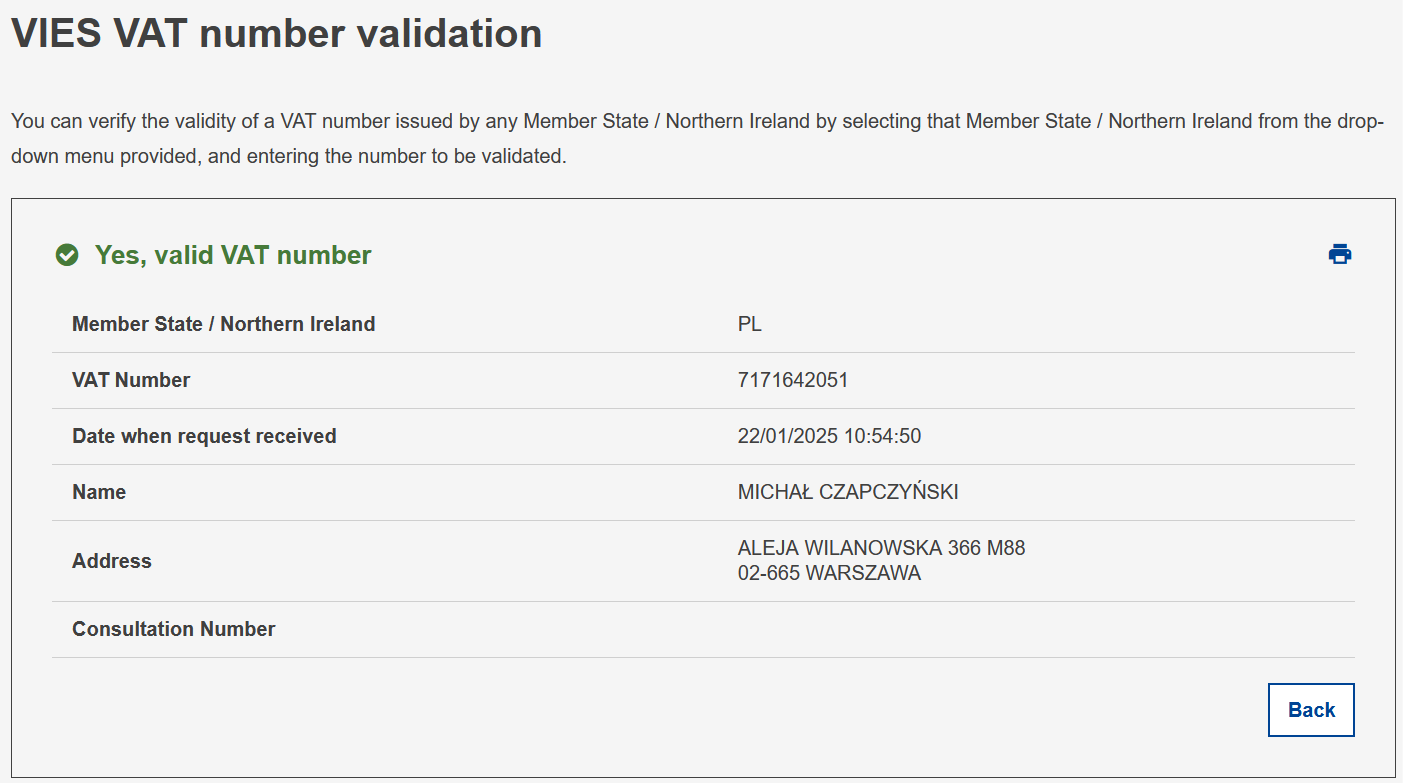

How to use the VIES system?

The VIES system is available online and is free. To verify a contractor, you need to:

1. Visit the official VIES website and fill in the mandatory fields:

2. Select the contractor’s country.

3. Enter their VAT number.

4. Receive confirmation of registration or information about lack of entry.

In case of no entry, it’s worth contacting the contractor directly or the tax office in the given country to clarify the situation.

If you have a problem with your or your contractor’s incorrect EU number, we encourage you to read the article on our blog: VIES – invalid EU VAT number during verification.

Benefits of automation and integration of VIES verification with business processes

Automation of the VAT verification process can significantly improve company operations, particularly in e-commerce. Solutions available on the market integrate accounting and sales systems with VIES, allowing for:

- Automatic verification of contractors when placing orders.

- Prevention of errors in documentation (invoices, orders, etc.).

- Time savings and cost reduction.

Cross-border trade in the EU opens access to a market of approximately 100 million potential buyers. However, with the growth of business scale, manual verification of EU VAT numbers becomes time-consuming and prone to errors.

Automation of this process using VIES API tools brings several benefits:

1. Time savings and cost reduction

- Elimination of manual checking for each contractor

- Possibility of mass verification of EU VAT numbers

- Automatic updates of contractor status

- Reduction of costs for key business processes related to sales

2. Increased transaction security

- Immediate verification of VAT number authenticity

- Automatic notifications of contractor status changes

- Minimization of tax fraud risk

- Compliance with EU legal requirements

3. Simple and quick integration with existing systems

- Easy implementation through REST API interface

- Possibility of integration with popular e-commerce platforms (via PHP library)

- Automatic archiving of verification confirmations (on the viesapi.eu user account)

- Access to complete history of checks

4. Practical applications of automation using VIES API tools

VAT EU automation verification is particularly valuable for companies that:

- Conduct sales in multiple EU markets

- Cooperate with a large number of contractors

- Need quick verification during the sales process

- Want to minimize the risk of documentation errors

5. Technical aspects of implementation

Libraries available through viesapi.eu offer:

- Easy to implement REST API

- Support for popular programming languages

- Technical documentation and implementation examples

- End users tools for mass VAT number verification (Excel Add-in, VIES Checker App)

6. Business benefits

VIES verification automation supports cross-border trade development through:

- Acceleration of new customer onboarding process

- Operational risk reduction

- Increase in company credibility

- Optimization of accounting processes

Summary

In the era of growing importance of cross-border trade in the EU, automation of VAT number verification becomes not just a convenience but a necessity for companies wanting to effectively compete in the international market. Using professional tools to automate this process allows focus on business development while ensuring security and compliance with regulations.

[1] Source: Eurostat – https://ec.europa.eu/eurostat/statistics-explained/index.php?title=E-commerce_statistics_for_individuals